When the ‘Civil Partnership & Certain Rights and Obligations of Cohabitants Act 2010’ (Civil Partnership Act) was passed, it created the legal status of civil partnership for same-sex couples.

This meant that the property and financial entitlements that previously only applied to married couples would now apply to registered civil partners. However the Act only applies to same-sex couples who have registered their relationship. This has caused some confusion for co-habitants of the opposite sex, who perhaps believed that they too should enjoy these financial entitlements.

Unfortunately this is not the case as the Act’s logic suggested that opposite sex couples could get married, whereas same-sex couples couldn’t. The Civil Partnership Act defined a qualified Co-Habitant as being “An adult who is in a relationship of cohabitation of 2 years or more (if dependent children are involved) or for 5 years or more in other instances” meaning that either can now legally claim from their deceased cohabitant’s estate.

However, little known to many is that inheritance tax will still be liable, and it will be payable at the Group C €16,250 threshold!

The Inheritance Tax Nightmare

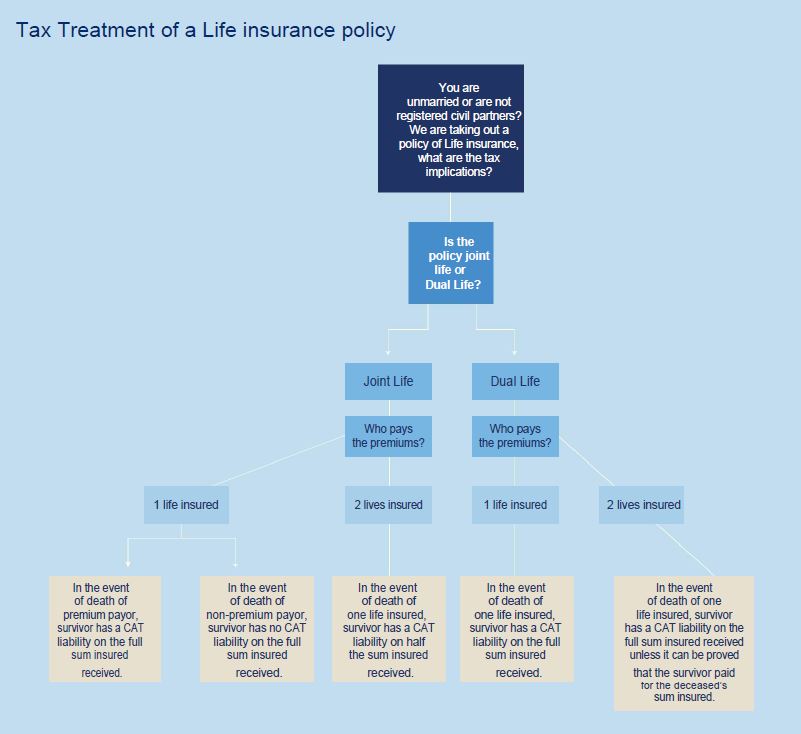

There are two important points to be aware of when arranging a protection policy for non-married/cohabiting couples:

- If they arrange a protection policy on their own lives for whatever purpose, the surviving partner may be left with an inheritance liability. If the survivor is deemed not to have paid premiums, problems arise! and

- That they are still treated as strangers in the eyes of Revenue so for inheritance tax purposes, the threshold which applies being €16,250.

Care is needed as to how policies are set up, with the following considerations

- Who pays the premiums?

- Can the small gifts exemption be used?

- The Dwelling House Exemption?

Let’s take the example of Ann and Tom

A co-habiting couple, Ann and Tom, decide to take out life cover of €300,000 on a joint life basis to cover any losses each may experience if one of them were to die. Tom is currently unemployed, so Ann will be paying the total premium on the policy until such time as he is employed.

What would the inheritance tax situation be if Ann were to die prematurely?

Unfortunately for Tom, as Ann has paid all the premiums, he is deemed to inherit the whole €300,000 from Ann and has to pay inheritance tax on it. Assuming he has not received any other assets under Group Threshold C previously, his tax liability is:

€300,000 – €16,250 x 33% = €93,637.50

If Tom was in a position to say he’d paid for half of the premiums out of their joint account, this would help reduce the tax liability by half, as it’d be assumed he’s inherited half of the sum insured.

€150,000 – €16,250 x 3% = €44,137.50

Either way, Tom pays Revenue within a certain time frame either the sum of

€93,637.50 or €44,137.50

What’s the solution?

The ‘Life of Another’ Arrangement

Under a simple ‘Life of Another’ arrangement, both Tom and Ann take out separate Life Insurance policies on each other, Tom insures Ann and vice versa. This means that each of the policies is owned separately, clearly identifiable and there should be no liability to inheritance tax as they each pay for their own policies.

Tom is unable to pay premiums, he is unemployed? This can be solved by Ann using the Small Gift Tax Exemption by ‘gifting’ the premiums to Tom which Tom will use to pay for the policy he owns.

The Small Gift Tax exemption is €3,000 a year from any one person to another, so if the premiums are below €3,000 a year, Tom can claim the premiums were gifts. Therefore in the scenario where Ann was to die, Tom receives the proceeds of the policy he owns without any liability to inheritance tax.

The ‘Section 72’ solution

Alternatively, each could take out a separate Section 72 life insurance policy to pay off any inheritance tax liability.

Section 72 policies are set up under Section 72 trust, meaning that the proceeds of such policies are exempt from inheritance tax insofar as the proceeds are used to pay inheritance tax. This arrangement may be more important to cover any tax liability for the dwelling house in which the couple are living.

For Tom and Ann, if they buy a house in joint names and one of them dies, the survivor may have a liability to inheritance tax on the value of the house (assuming the house is held as joint tenants). However in this case they may be able to avail of the Dwelling House Exemption.

The Dwelling House Exemption provides a complete exemption from inheritance tax on the value of their home, provided certain conditions are met, basically, that it was and continues to be their home but with having no other interest in any other property.

So, if either Tom or Ann had previously owned a property before they met and continued to own it when they began co-habiting, they would not be able to avail of the relief and would have a liability to inheritance tax on the property – not an unusual situation for couples.

Tom and Ann’s house is valued at €500,000 and they contribute equally to deposit, mortgage repayment and joint mortgage protection policy.

Again, if Ann were to die, Tom inherits the house but because he still owns a property purchased a few years back, he is unable to avail of the Dwelling House Exemption. The mortgage is cleared by the mortgage protection policy and he inherits Ann’s 50% of the property, so his inheritance tax liability is

50% of property = €250,000

Threshold for Tom = €16,250

Residual taxed = €233,750 x 33% = €77,137.50

The solution in this case would be to either increase the sum insured on the mortgage protection policy to cover the inheritance tax liability or take out a Section 72 policy so the inheritance tax liability is cleared.

Both Tom and Ann could take out a policy on their own life and hold it under Section 72 Trust, with the other being the beneficiary. In the event of either dying, the sum insured is payable to the survivor as beneficiary, who uses the money to pay off any inheritance tax liability.

At Mullane Financial Services we regularly help with setting up solutions for co-habiting couples.

If you’ve any queries, please don’t hesitate to get in touch with John on 061-469 700 or email info@johnmullane.net

John Mullane Mortgage & Financial Services Ltd t/a Mullane Financial Services

Telephone: 061 469700 Email:mailto:info@johnmullane.net Website: https://www.johnmullane.net

John Mullane Mortgage & Financial Services Ltd t/a Mullane Financial Services is regulated by the Central Bank of Ireland.

Zurich Life Assurance plc

Zurich House, Frascati Road, Blackrock, Co. Dublin, Ireland.

Telephone: 01 283 1301 Fax: 01 283 1578 Website: www.zurichlife.ie

Zurich Life Assurance plc is regulated by the Central Bank of Ireland.

The information contained herein is based on Zurich Life’s understanding of current Revenue practice as at March 2017 and may change in the future. Intended for distribution within the Republic of Ireland.