Brexit uncertainty and Global corporation tax threaten a positive forecast for Ireland in 2018;

Rising house prices create economic vulnerability as debt levels

In the latest Friends First Economic Outlook ‘2018: Strong tail winds and some head winds’, published today Jim Power, chief economist at Friends First, forecasts full year GDP growth of 4.8% for 2017, an increase on the 4.3% guided earlier in the year and forecast by the Department of Finance for full year 2017 (Budget 2018). Power anticipates that real GDP could expand by 4% in 2018, slightly ahead of the Government GDP forecast of 3.5%.

The report notes that as we move towards 2018, the momentum in the Irish economy is strong and prospects for the coming year look promising and are boosted by strong tail winds from global economic improvements. However, the uncertainty pertaining to external factors such as Brexit negotiations, as well as global corporation tax developments present potential challenges to the Irish economy over the next 12 months. With a forecasted rise in house prices of up to 15% in 2018, an increase in housing supply is identified as a critical issue that must be addressed to safeguard from a surge in debt levels, which could threaten overall economic stability.

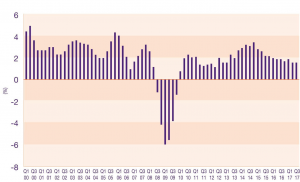

Euro Zone GDP Year on Year

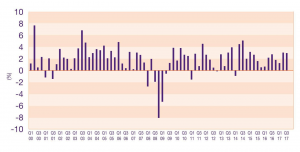

US GDP Year on Year

UK GDP year on year

THE IRISH ECONOMY: Strong tail winds with some head winds

The report shows solid, broadly based growth momentum in the Irish economy during 2017. Consumer spending is noted to be improving with relatively high consumer confidence year-to-date, which has been supported by employment growth of 2.9%; average wage growth of around 4%; a modest easing of the tax burden; and growth of around 6% in personal disposable incomes.

Despite the recovery, the challenges facing Ireland in 2018 are clearly defined in the report. The principal factors include:

- a chronic lack of housing,

- under-funded and inefficient public services,

- managing the balance between public expenditure and taxation,

- growing wage and other business cost pressures,

- and, of course, Brexit.

Commenting on this, Jim Power, Chief Economist with Friends First said: “It is clear that Ireland continues to enjoy broadly based growth. The global economic background is looking increasingly better and most domestic indicators are positive. For a small open economy like Ireland, the stronger global backdrop is very important and the world economy seems to be in the sweetest growth spot for a decade. Just as the Irish economy was taken down by the collapse in the global economy after 2007, it is currently being driven forward by the strong showing of the global economy over the past year.

With real GDP expected to expand by at least 4.8% in 2017, 4% in 2018 and an average of 3.5% per annum out to 2020, such an economic out turn would describe an economy gradually getting better over time. However, the domestic and external challenges will need careful management by policymakers as we look to 2018.”

GBP versus Euro over 10 years to 2017

US dollar versus Euro over 10 years to 2017

EU Health

Key Points

- 2017 has turned out to be a good year for the global economy, with an improving trend almost everywhere. The US economy expanded at a steady pace; the Euro Zone economy is showing compelling signs of a geographically broad-based and increasingly sustainable economic recovery; and the emerging economies, including China, are doing reasonably well. The UK economy has not surprisingly lost some momentum.

- The global growth outlook for 2018 looks positive. Notwithstanding the obvious risks, the world economy seems to be in the sweetest spot for a decade and growth is likely to surprise on the upside in the coming year.

- Official interest rates everywhere were taken down to historically low levels in the aftermath of the global financial crisis reflecting the weakness of the global economy and the nature of the unprecedented challenge facing policy makers. As the global economic weakness dissipates, official interest rate policy is starting to change. Since December 2015, the Federal Reserve has taken official interest rates from 0 to 1.25%. Another rate increase looks likely in December and rates could rise by another 1% during 2018.

- The Bank of England increased its base rate from 0.25% to 0.5% in November, which was the first interest rate increase in a decade. This increase was prompted by the uptick in inflation to 3%. With the economy clearly losing some momentum, it is unlikely that this is the beginning of a sharp monetary policy tightening. Rates could rise by around 0.5% during 2018.

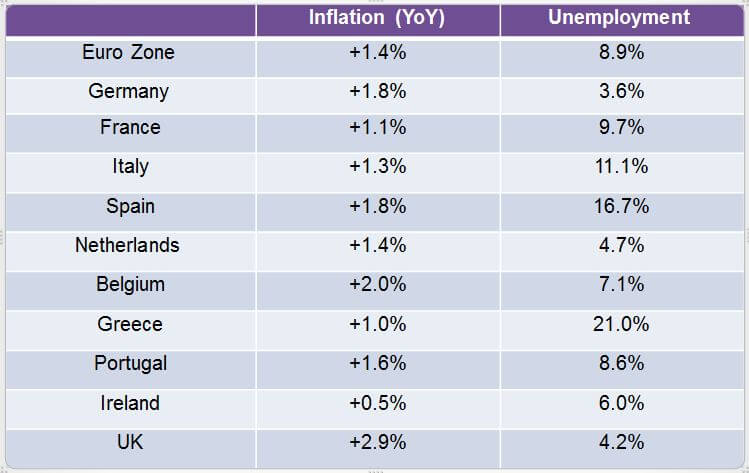

- The European Central Bank remains very relaxed about interest rates, despite the relatively strong growth recovery. Inflation remains well behaved at 1.4% and although the labour market is improving significantly, unemployment still remains at a high 8.9%. Later in 2018, the ECB will cease its bond buying programme under QE, but it is likely to be 2019 before official rates start to move back towards normality.

- Although equity markets look modestly overvalued, they are likely to be supported in 2018 by economic recovery and solid growth in corporate earnings. It is not easy to see what would cause a significant correction just yet. With official interest rates and bond yields remaining very low and with Quantitative Easing (QE) still leading to lots of liquidity, markets can certainly go higher from here, but the reversal of QE and monetary tightening could impact at some stage. On balance, 2018 is likely to see more modest equity market gains than in recent years.

- In difficult circumstances, sterling has held up relatively well. The currency could have fallen much further. Sterling has been supported somewhat by a reasonably robust economy and an increase of 0.25% in UK interest rates in early November. Looking ahead to 2018, sterling is likely to remain volatile, but it looks vulnerable to further weakness.

- The growth momentum in the Irish economy during 2017 has been solid and broadly based. Consumer spending is getting gradually better; consumer confidence is quite high; exports are doing well; and the public finances are continuing to improve. In 2018, we are likely to see an ongoing improvement in economic conditions, notwithstanding the challenges posed by Brexit.

- As we move towards 2018, the momentum in the Irish economy is strong and prospects for the coming year look promising. The global economic cycle is steadily improving, with the US and the Euro Zone in particular showing solid momentum. The impact of Brexit is starting to be felt on the UK economy, which is not surprising, as uncertainty is the enemy of business and consumer confidence. The only thing we can say with certainty about Brexit is that it is characterised by deep uncertainty.

- Despite the recovery, the challenges facing Ireland are very clear. The main ones are a chronic lack of housing, under-funded and inefficient public services, managing the balance between public expenditure and taxation, growing wage and other business cost pressures, and of course Brexit. These challenges will have to be faced up to and will require strong political leadership.

- There is a lot of heat in the housing market at the moment and it does look set to get worse. Demand is being driven higher by solid fundamentals such as population growth, employment creation, an improvement in credit availability, and a basic improvement in confidence about Ireland’s future. On the supply side, we are simply not building enough houses for a variety of reasons, but official policy has not and is not helping the situation.

- Not surprisingly, the debate has started again about the bubble-like properties of the market. The crunch for any market comes when it is hit by a shock, such as the sub-prime crisis back in 2008. If rising house prices have pushed debt levels higher, which is now happening, then the whole market and the economy becomes very vulnerable as we found out a decade ago. We need to increase housing supply as a matter of urgency. That is the only real solution. Meanwhile, national average house prices look set to rise by up to 15% in 2018.

- For a small open economy like Ireland, the stronger global backdrop is very important. Consequently, real GDP should expand by at least 4.8% in 2017.

- Real GDP should be capable of expanding by around 4% in 2018.

- It is essential that national policy focuses very strongly on broadly-defined competitiveness. This includes wages and other business costs; IT infrastructure and capability; high quality public services; prudent management of the public finances; and the personal tax burden.

- The two biggest threats to Ireland in 2018 and thereafter will be posed by Brexit and global corporation tax developments, which have the potential to pressurise Ireland’s FDI model over the coming years. There will have to be a greater focus on providing support to the indigenous economy.

Jim Power,

Chief Economist,

Friends First

The views and opinions expressed in this article are those of the author.

Originally published on www.friendsfirst.ie December 2017